Objective profit: How to save 1.2 trillion USD

Vegan Society of Canada News

May 18th 2019

Today we're going to look at a very important part of motivation: Profit. We could discuss how profit is not the best motivation to have and we could even discuss why having legal entities whose sole purpose is to maximize profit was not one of our brightest idea and is probably one of the reason we are where we are today. Nevertheless, it would be foolish to ignore that for many entities profit is the driving motivation.

As usual with most things there are pros and cons. The advantage of being motivated by profit is once we are faced with evidence that our actions maximize loss instead of profit we are obligated to change course. Accordingly, we spent weeks reviewing the research behind two extensive reports recently published by Mercer and the United Nations Environment Program Financial Initiative (UNEPFI) to address the concerns of a large segment of our society and hopefully put to rest the misconception that implementing our commitment to the Paris Climate Change agreement of staying well below 2°C will result in overall economic loss when compared to inaction.

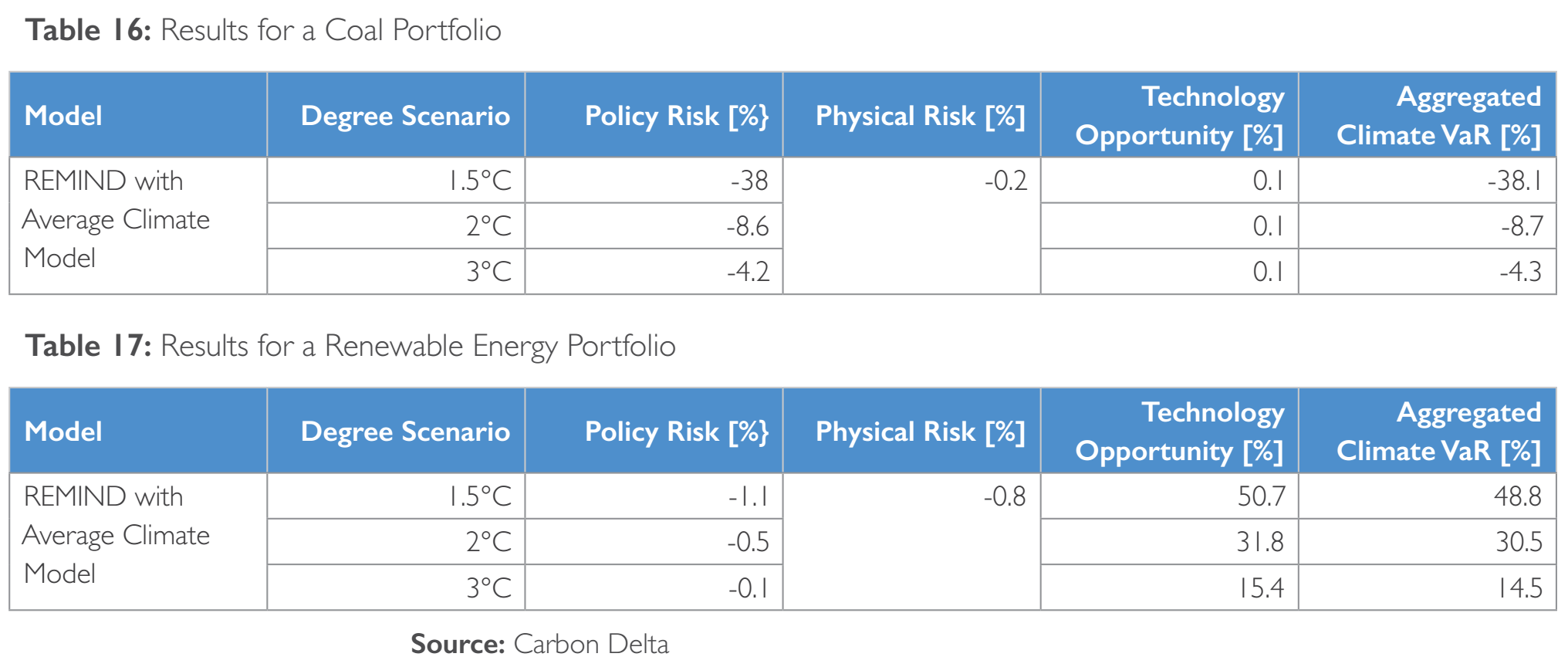

The two reports would initially seem to reach different conclusions and this is when going beyond the headlines is necessary. Mercer’s report is clear and conclude that overall the global economic impact, as measured by GDP, of a 2°C scenario is less then a 3°C, which is in turn less than 4°C scenario.

The UN report on the other hand seems to predict a greater loss under a 1.5°C scenario than a 3°C scenario, so what is going on?

While both report predict broad GDP and/or global portfolio decline it is important to understand they are looking at it through different lenses. The UN analysis only looks at climate change risks and impact on portfolio for the next 15 years:

Of extreme importance are distinct limitations to physical analysis under the timelines useful for investment decision-making. This modelling is limited to a time window of 15 years, within which the manifestation of physical impacts remains limited and similar between emissions pathways. It is beyond those 15 years that the physical impacts of climate change are forecasted to drastically intensify, especially under higher GHG emissions pathways of 3°C and beyond. Therefore, although analysis results for physical risk look similar across the scenarios for the first 15 years shown, much higher costs for physical risk for high warming scenarios (3°C and beyond) out to 2100 should be anticipated when interpreting CVaR at the aggregate level.

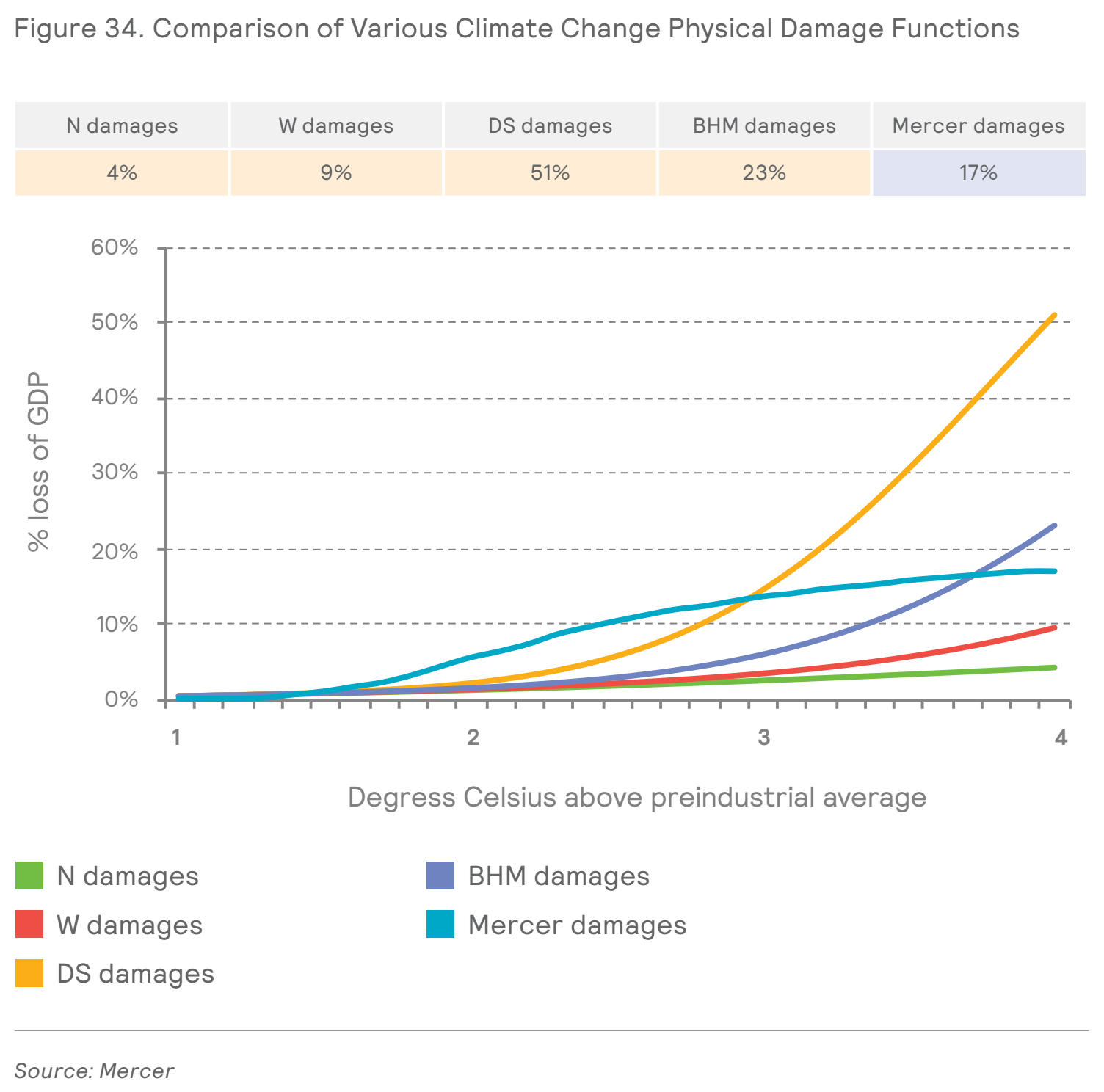

This is why the UN table forecast a physical risk of -2.14% while Mercer’s damage function predict -17%. From this quote we can assume that if the UN analysis had been carried out like Mercer’s to year 2100 physical damages would have transformed the table to mirror Mercer’s conclusion that the losses increase as the warming increases. Furthermore, other damage function predict even more physical damages and that is because Mercer’s damage function has some limitation in various areas. Nevertheless, the estimations of physical damage due to flood and wildfire is probably the best we have seen so far. Therefore the 17% GDP loss at 2°C could still be underestimated as the Mercer damage function does not take into account the social factor of Burke, Hsiang and Miguel (2015) nor the climate tipping points of Covington and Thamotheram (2015).

It is interesting to note the different curve shapes that these different damage functions produce: Exponential when taking into account social factor and climate tipping point and linear/logarithmic when taking into account physical damages. Not taking into accounting social factors is a serious flaw, especially in higher warming scenario. We all hope that we will never go above 4°C, but even baseline scenarios predict as high as 4.8°C so it is certainly not outlandish to suggest our foolishness could result in an increase of 4°C-6°C. Accurately modeling those impact is crucial since scientifically there seem to be a point where exponential loss would be triggered. The human body can only tolerate so much heat and therefore there is a point at which human being can no longer easily survive and climate damage approach 100%. It is theorized that a warming of 3°C to 4°C would halve the margin of safety for heat stress in certain location and a warming of 11°C to 12°C would make most of the planet a place where metabolic heat dissipation would for the first time become impossible, calling into question its suitability for human habitation (Sherwood, Huber 2010). This implies that the true damage function cannot be purely linear like Mercer’s damage function. However, it is also clear that a pure exponential damage function does not model well all the physical damage that are occurring even starting below 2°C. It seems that the true damage function might be linear or logarithmic up to a certain point and then shift to a more exponential function somewhere around 2°C to 4°C. Hopefully further research can better estimate the overall damage of climate change in case any doubt remain that inaction is still an option.

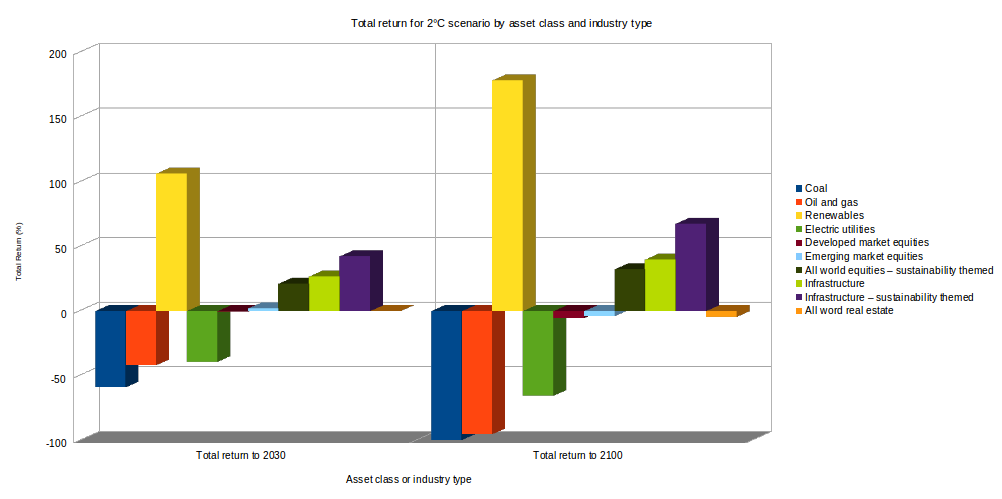

Another interesting aspect that both reports agree on is that loss will not be uniform across asset classes and industries. While some industries could see themselves wiped out like fossil fuels, others will flourish and investment opportunities in a 2°C scenario will abound. Below is the expected total return of various asset classes

The UN report also comes to the same conclusion:

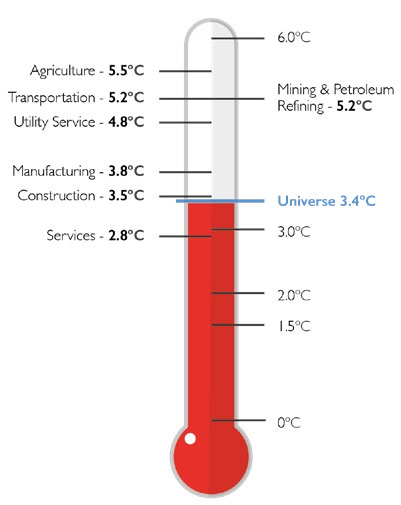

It is important to note that of all the industry it is not the fossil fuel, mining, transportation or utilities sector that is the most misaligned with a 1.5°C goal but the agricultural sector

It has been known for some time that animal agriculture is a major contributor to climate change. As we have seen in previous article, animal agriculture is responsible for anywhere between 14% to 51% of GHG emissions. Therefore it should be no surprise to anyone that the agriculture sector has the highest warming potential of all industries. We hope this should make it finally clear to everyone that any meaningful climate change policy without addressing animal agriculture is deeply flawed and will fail to limit our increase to below 2°C let alone 1.5°C.

Overall there is simply no scenario in which inaction result in more profit than action. While someone skimming through the UN report may think that inaction would increase profit, the report shatter this misconception:

Finally, if governments delay action to enact climate policies that reduce GHG emissions, the 30,000 companies in the universe face a further cost of USD 1.2 trillion as compared to a scenario where climate policy is enacted smoothly and steadily with immediate effect. Furthermore, delayed action not only increases policy risk, but also results in much greater physical climate risk due the increased accumulation of GHG concentrations in our atmosphere.

When people claim addressing climate change is too costly, it is more likely they are referring to the cost to incumbent industries and to that effect it is correct. Nevertheless, while some incumbent industry risks being completely wiped out it will create various opportunities in emerging industries and the overall benefit will be positive. Mercer also reminds us that those return are likely not to be uniformly distributed:

The variance around these mean return impacts is likely wide, with a particularly significant negative tail in the hypothetical distribution around the 3° C and 4°C outputs.

The scenarios modeled are deterministic, which is necessary given the gaps in scientific research and our current understanding of climate change (not to mention the complexity of conducting investment analysis 80 years into the future). However, the interactions are likely to be much more complex than we can ever model. The magnitude of results — particularly related to physical damages — is likely underestimated.

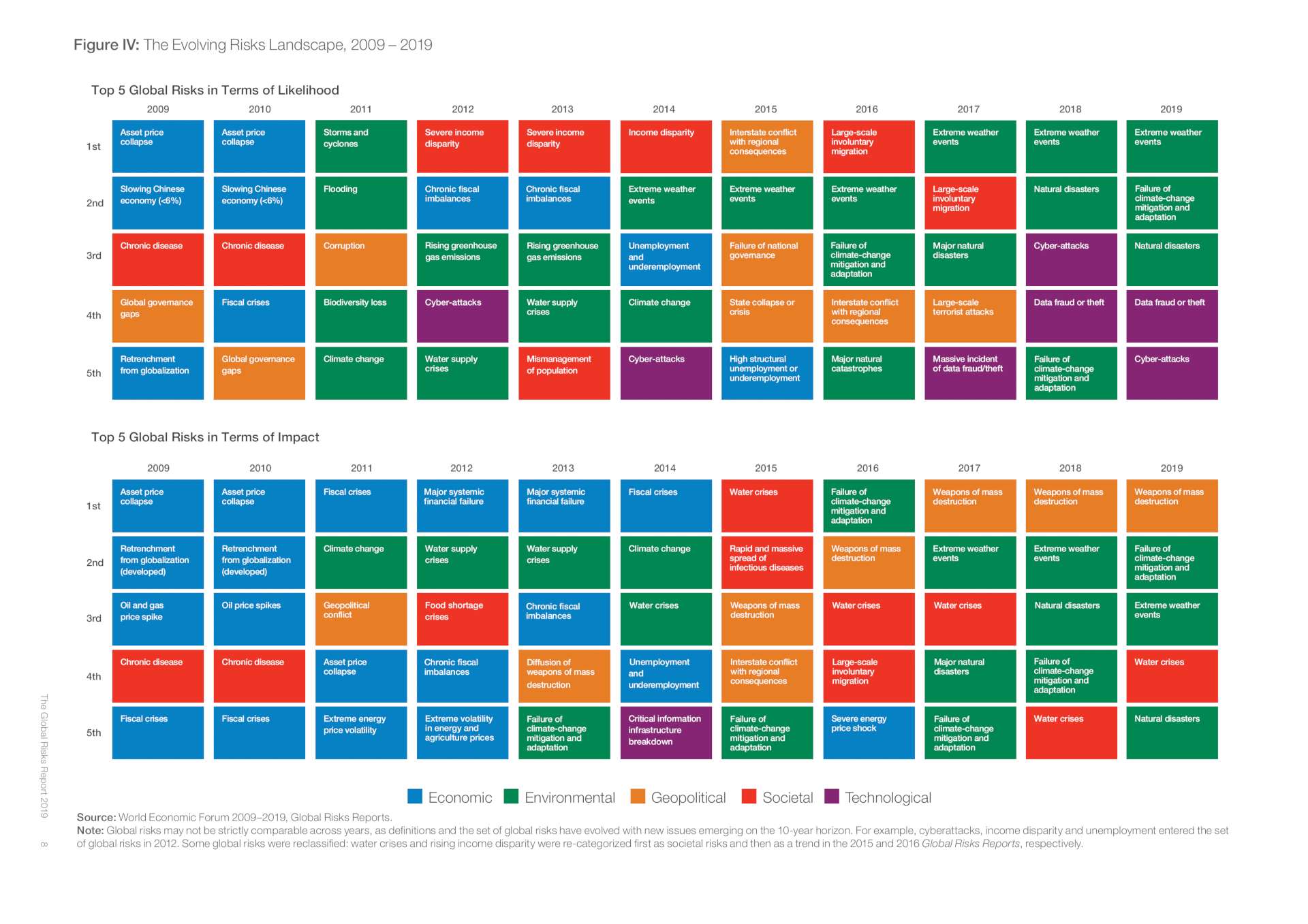

Hopefully it is now clear that the view that fighting climate change will result in lower overall economic output is incorrect. In their Global Risks Report of 2019 the World Economic Forum echoes the enormous risks that climate change pose. The graph below clearly shows how the global risks landscape evolved over the last decade:

We now see that 80% of the top five global risks in term of impact are dominated by environmental and societal factors caused by climate change. Those risks are now clear and well understood, it is unlikely that investors especially large pension funds will tolerate the consequence of climate change on their investments being ignored. Investors worldwide are playing a dangerous game of musical chair. Executive management at various fossil fuels, animal agriculture and related corporations are being valued based on reserve and unabated growth that is simply impossible without putting an end to society as we know it. The timing of this global awareness and market repricing will be part of this great variation in returns. Mercer’s tried to model market awareness in their stress-testing model:

Testing an increased probability of a 2°C scenario with increased market awareness can result in sector-level returns where renewables increase by more than 100% and coal decreases by nearly 50%. Positive asset class impacts include infrastructure at almost 23% and sustainable equity at more than 5%. Testing an increased probability of a 2°C scenario or a 4°C scenario with greater market awareness, even for the modeled diversified portfolios, results in +3% to -3% return impacts in less than a year.

Nobody wants to be left standing when the music stop and unfortunately it is the nature of the financial markets that some will. However, who will be ultimately held responsible for all this damage is still unclear. A paper by UK law firm Pinsent Masons conclude:

in cases where climate change has the potential to impact on long-term investment performance, pension scheme trustees have a fiduciary duty to consider climate change risk when making their investment decisions.

Mercer also remind portfolio manager that those who fail to take into account climate change will do so at their own risks:

As signals from regulators become stronger and/or more investors take action, those that fail to consider, manage and disclose their potential portfolio specific risks may be susceptible to legal challenges in the future.

We hope this report will make it clear that the consequence of inaction are simply unacceptable from any view point. In their report Mercer conclude:

Fiduciaries — motivated by the economic and social interest of their beneficiaries and clients — have the opportunity, and arguably the obligation, to use their portfolios and their influence to help guide us toward this more economically secure outcome.

A change of lifestyle offers individuals a powerful means to combat a range of issues, including personal health problems, climate change, loss of biodiversity, global acidification, eutrophication, freshwater shortages, pandemic prevention, antibiotic resistance, save countless lives and much more. We know of no other efficient way for individuals to address these critical challenges simultaneously without waiting for government, corporate, or technological interventions. By changing lifestyle, people can take immediate and impactful action. We encourage you to embrace this lifestyle change today. Contact us for support and to connect with local communities in your area.